Funding options are more diverse than ever, offering entrepreneurs and companies new ways to raise capital for growth and expansion. Among these options, crowdfunding has emerged as a powerful tool for businesses seeking to secure funds without relying solely on traditional financing methods like bank loans or venture capital. Crowdfunding allows businesses to access a broad pool of potential investors or backers, democratizing the funding process and offering innovative ways to engage with a target audience. To successfully leverage crowdfunding for business expansion, entrepreneurs must understand how the system works, select the right platform, create compelling campaigns, and manage their crowdfunding ventures effectively to achieve their expansion goals.

Understanding Crowdfunding: An Overview

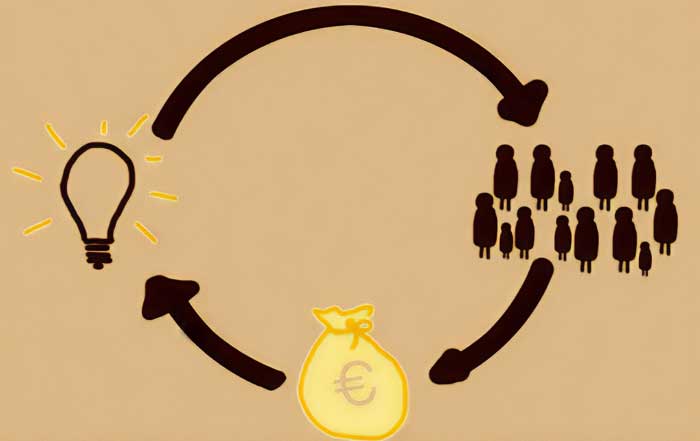

Crowdfunding, in its simplest form, involves raising small amounts of money from a large group of people, typically through online platforms. These platforms serve as intermediaries between businesses and their potential backers, enabling entrepreneurs to present their projects and campaigns to a wide audience. In return for their contributions, backers may receive rewards, equity, or other incentives depending on the type of crowdfunding campaign being utilized. The four main types of crowdfunding include reward-based, equity-based, donation-based, and debt-based (peer-to-peer lending).

Reward-based crowdfunding allows backers to contribute in exchange for non-monetary rewards such as early access to products or services, while equity-based crowdfunding enables contributors to invest in a company in exchange for shares or ownership. Donation-based crowdfunding is philanthropic, where backers provide financial support without expecting any tangible return, and debt-based crowdfunding involves contributors lending money to a business, which is repaid with interest over time. Each model offers distinct benefits, and businesses looking to expand must carefully consider which type of crowdfunding is most suitable for their growth objectives.

Choosing the Right Crowdfunding Platform

One of the most crucial steps in leveraging crowdfunding for business expansion is selecting the appropriate platform for the campaign. With numerous crowdfunding platforms available, each catering to different types of businesses and funding models, it is essential for entrepreneurs to research and identify the platform that aligns with their goals, audience, and type of funding required. Some of the most well-known platforms include Kickstarter, Indiegogo, GoFundMe, and Republic Europe (previously Seedrs), each of which serves a specific niche or industry.

Kickstarter and Indiegogo are popular platforms for reward-based crowdfunding, where creative projects, tech startups, and small businesses often launch campaigns to raise funds for product development or expansion. On the other hand, Seedrs and Crowdcube focus on equity-based crowdfunding, providing startups and established businesses with access to investors in exchange for equity or shares. For businesses in need of debt financing, platforms such as Funding Circle offer peer-to-peer lending opportunities, allowing businesses to raise capital through loans from individual investors. Understanding the platform’s audience, campaign structure, and fees is critical to ensuring the campaign reaches its target and meets the company’s financial goals.

Crafting a Compelling Crowdfunding Campaign

The success of a crowdfunding campaign hinges on its ability to resonate with potential backers or investors. Crafting a compelling campaign requires a combination of storytelling, clear communication of business goals, and the presentation of tangible benefits for contributors. A business expansion crowdfunding campaign must convey not only the need for funding but also how the raised capital will be used to drive growth and deliver long-term value.

A well-crafted campaign typically begins with a strong narrative. Entrepreneurs need to share the story behind their business—why it was founded, what challenges have been faced, and how the funds will help take the business to the next level. The more personal and relatable the story, the better it will connect with potential backers. Additionally, the campaign should clearly outline how the funds will be allocated, whether it’s for product development, entering new markets, increasing production capacity, or investing in marketing and customer acquisition.

Visual elements such as high-quality images, videos, and infographics can enhance the appeal of the campaign. A short, engaging video that introduces the team, showcases the product or service, and explains the expansion strategy can be particularly effective in grabbing attention and converting viewers into backers. Visuals help potential contributors envision the impact of their support and make the campaign more memorable.

Setting Realistic Financial Goals

One of the most common mistakes in crowdfunding is setting unrealistic financial targets. While it may be tempting to aim for a large amount of capital, setting a target that is too high can deter potential backers, especially if they perceive the goal as unattainable. Entrepreneurs should strike a balance between raising enough funds to meet their business expansion needs and setting a goal that seems achievable within the campaign's timeframe.

To determine a realistic funding goal, businesses should first calculate the exact amount required for expansion, taking into consideration the costs of production, marketing, distribution, and platform fees. Many crowdfunding platforms operate on an “all-or-nothing” basis, meaning that if the funding goal is not met, the business receives nothing. As such, setting a lower, more achievable goal can increase the likelihood of success while offering the potential to raise more if the campaign gains significant momentum. Entrepreneurs must also plan for any contingencies and ensure that their financial projections are accurate and justifiable when communicating them to backers.

Engaging with Backers and Building Trust

Crowdfunding is not just about raising money; it’s about building relationships and trust with a community of supporters who believe in the business and its mission. Throughout the campaign, entrepreneurs must maintain active communication with backers, providing regular updates on progress, challenges, and milestones. This engagement fosters a sense of transparency and loyalty, encouraging backers to continue supporting the business even after the campaign ends.

One way to build trust is by offering attractive rewards or incentives for early backers. Reward-based crowdfunding campaigns often provide tiered rewards, where backers receive increasingly valuable benefits depending on their level of contribution. Offering exclusive rewards such as limited-edition products, personalized experiences, or access to behind-the-scenes content can create excitement and incentivize higher levels of support. For equity-based crowdfunding, businesses can provide detailed financial projections and business plans to instill confidence in potential investors, demonstrating the viability of the company’s growth strategy.

Backer engagement doesn’t end when the campaign closes. After a successful crowdfunding campaign, maintaining ongoing communication with backers is crucial for building long-term relationships. Businesses should continue providing updates on how the funds are being used, share progress reports, and celebrate key milestones. This ongoing connection can lead to increased brand loyalty, repeat business, and additional investment opportunities down the line.

Marketing and Promoting the Crowdfunding Campaign

A crowdfunding campaign is only as successful as the number of people who see and engage with it. For this reason, marketing and promotion play a pivotal role in driving traffic to the campaign page and converting visitors into backers. Businesses must take a multi-channel approach to marketing, leveraging social media, email marketing, PR, and influencer partnerships to reach a broader audience.

Before launching the campaign, entrepreneurs should build anticipation and awareness by teasing the upcoming crowdfunding initiative on their website, social media platforms, and through email newsletters. Pre-launch marketing can include countdowns, behind-the-scenes content, and sneak peeks at rewards, all designed to create buzz and encourage early contributions. Engaging with influencers or industry experts who can endorse the campaign and share it with their followers can also provide a significant boost in visibility.

During the campaign, businesses should maintain a consistent marketing effort, posting regular updates, testimonials from early backers, and any media coverage that the campaign receives. Social media platforms like Facebook, Instagram, Pinterest, and LinkedIn can be powerful tools for reaching a wider audience and fostering real-time engagement with potential backers. Paid advertising, particularly on platforms where the target audience is active, can also help drive traffic to the campaign page.

Managing a Successful Campaign Post-Launch

The work does not stop once the crowdfunding campaign has reached its funding goal. In fact, managing the post-launch phase is equally important, as this is the time when businesses must deliver on their promises to backers. Whether it’s producing a new product, expanding into new markets, or increasing production capabilities, entrepreneurs must ensure that the funds are allocated efficiently and that all milestones are met.

Transparency and communication remain key during this phase. Regular updates on the progress of the project, any delays, and future plans keep backers informed and reassured that their contributions are being put to good use. Managing timelines effectively and meeting delivery expectations are crucial for maintaining the trust and loyalty of backers, as failure to deliver on promises can harm the business’s reputation and jeopardize future funding opportunities.

Additionally, businesses should evaluate the success of the crowdfunding campaign from a strategic standpoint. By analyzing data on backer demographics, funding sources, and campaign performance, entrepreneurs can gain valuable insights into their audience and identify areas for improvement in future crowdfunding initiatives. Many businesses that have successfully used crowdfunding for expansion find that their backers become long-term customers and advocates, providing ongoing support well beyond the initial campaign.

Crowdfunding for Business Expansion Quiz

The Future of Crowdfunding for Business Expansion

As technology continues to advance and global connectivity increases, crowdfunding is expected to play an even more significant role in business expansion strategies. With the rise of blockchain technology and decentralized finance (DeFi), new forms of crowdfunding, such as tokenization and cryptocurrency-based funding, are emerging, offering businesses and investors new ways to engage and transact. Moreover, the growth of niche crowdfunding platforms catering to specific industries or causes will provide entrepreneurs with more targeted avenues for raising capital.

For businesses looking to expand in the future, leveraging crowdfunding will remain a viable and attractive option, particularly as more consumers and investors become comfortable with online platforms and digital transactions. However, success in crowdfunding will continue to require careful planning, creative marketing, and a genuine commitment to engaging with supporters. Entrepreneurs who can master these elements will be well-positioned to harness the power of crowdfunding to fuel their business expansion goals and achieve long-term growth.

In conclusion, leveraging crowdfunding for business expansion offers companies a unique and democratized way to raise funds, engage with their target audience, and grow their brand. By selecting the right platform, crafting compelling campaigns, setting realistic goals, building trust with backers, and maintaining strong post-launch management, businesses can successfully use crowdfunding to scale their operations and achieve their expansion objectives. As the crowdfunding landscape continues to evolve, businesses that embrace this method of financing will find themselves at the forefront of innovation and growth in the years to come.