2025 is set to offer numerous global business opportunities, driven by technological advancements, changing consumer behaviors, and an increasingly interconnected economy. In a landscape where businesses need to adapt quickly and innovate to stay competitive, understanding emerging markets, trends, and key industries will be essential for entrepreneurs and investors alike. From renewable energy to artificial intelligence, the business landscape of 2025 is rife with potential, providing a wealth of opportunities for those who are proactive and prepared.

1. Renewable Energy and Sustainability

The global shift towards sustainability and renewable energy sources has been accelerating for years, and by 2025, this sector is expected to dominate global investment. With increasing governmental regulations on carbon emissions, consumer demand for eco-friendly products, and the need for alternative energy solutions to combat climate change, renewable energy stands out as a key business opportunity. Solar, wind, hydropower, and bioenergy projects will continue to expand as governments and businesses invest heavily in infrastructure to meet global sustainability goals. Moreover, innovations in energy storage, such as advancements in battery technology and smart grids, present further opportunities for businesses willing to venture into this rapidly growing market.

Entrepreneurs focusing on clean energy technologies, electric vehicle infrastructure, or sustainable materials will find ample room to innovate. Solar panel production, installation, and maintenance, as well as wind turbine engineering and energy-efficient product manufacturing, will see increased demand. Additionally, businesses that develop technologies to reduce energy waste in manufacturing and logistics or create new ways to recycle materials will also play a pivotal role in shaping the future of sustainability-driven economies.

2. Artificial Intelligence and Automation

Artificial Intelligence (AI) and automation continue to revolutionize industries across the globe, transforming how businesses operate, innovate, and scale. By 2025, AI's impact on industries such as healthcare, manufacturing, finance, and transportation will be even more profound. AI-based business models that leverage machine learning, natural language processing, and predictive analytics will streamline operations, improve decision-making, and enhance customer experiences. The potential applications are vast, ranging from AI-driven medical diagnostics to automated supply chain management and intelligent financial trading algorithms. In particular, the integration of AI with robotics and automation will create enormous business opportunities in sectors like manufacturing and logistics. Automation systems that can improve production efficiency and reduce human error will be in high demand as companies seek to reduce costs and increase productivity. Moreover, businesses that offer AI-driven customer service solutions, such as chatbots and virtual assistants, will find expanding markets as more companies look to enhance their digital customer experiences. For those looking to enter the AI space, opportunities exist in software development, data analytics, AI-as-a-service platforms, and AI consulting services. Additionally, entrepreneurs who can develop AI-powered tools that can be easily integrated into existing business operations, such as automated marketing platforms, personalized healthcare systems, or AI-enhanced cybersecurity, will find themselves in high demand.

3. Health and Wellness Technology

The health and wellness industry has been undergoing significant transformation, and by 2025, it will be even more tech-driven, with digital health solutions, telemedicine, and personalized wellness plans at the forefront. The demand for healthcare technology was greatly accelerated by the COVID pandemic, and the trend towards remote healthcare services, wearable health devices, and AI-powered diagnostics is expected to grow exponentially in the coming years. Businesses that can develop innovative solutions to enhance patient care, monitor health remotely, and provide personalized treatments will have a significant advantage.

Wearable health technology, which tracks biometric data like heart rate, blood pressure, sleep patterns, and physical activity, is set to become more sophisticated and widespread. Entrepreneurs can explore opportunities in developing smart health devices that integrate with AI to provide personalized health recommendations or diagnostic tools that utilize big data to predict and prevent illnesses. Additionally, telemedicine platforms that offer remote consultation services will continue to expand, particularly in regions where access to healthcare is limited.

Also, mental health technology and wellness apps that offer solutions for managing stress, anxiety, and overall well-being are growing in popularity, presenting business opportunities for developers and investors alike. Startups focused on creating platforms that offer mindfulness training, virtual therapy sessions, or tools for tracking mental health progress will find themselves well-positioned in this burgeoning market.

4. E-Commerce and Digital Marketplaces

E-commerce has been booming for years, but by 2025, digital marketplaces will offer even more lucrative opportunities as online shopping becomes further ingrained in global consumer behavior. The rise of e-commerce giants like Amazon, Alibaba, and Shopify has paved the way for a new era of online business opportunities, from niche product marketplaces to personalized shopping experiences driven by AI. The proliferation of mobile devices, increasing internet accessibility, and growing consumer trust in online transactions will continue to push the e-commerce sector to new heights.

In addition to traditional e-commerce models, social commerce, where consumers can purchase products directly through social media platforms, is expected to flourish in the coming years. Businesses that can tap into this trend by integrating their offerings with platforms like Instagram, TikTok, and Facebook will have a significant edge. Influencer marketing, which drives social commerce, will remain a key component of digital marketing strategies, creating opportunities for brands and influencers to collaborate more closely on product launches and promotions.

There will also be a rise in personalized e-commerce experiences where data-driven algorithms suggest products based on individual preferences, purchase history, and browsing behavior. Entrepreneurs and developers who can create custom online shopping experiences tailored to specific demographics or niches will find abundant opportunities. Additionally, businesses that can innovate in areas such as subscription-based e-commerce, one-click checkout processes, or digital payment solutions will be well-positioned to thrive in the competitive landscape of 2025.

5. Blockchain and Cryptocurrency

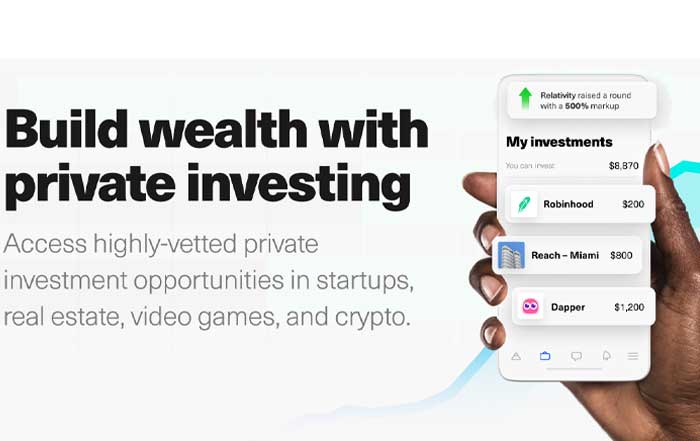

The blockchain and cryptocurrency industry has seen immense growth in recent years, and by 2025, it will become even more mainstream as more industries explore blockchain applications beyond financial services. While cryptocurrency investments like Bitcoin and Ethereum have dominated headlines, the underlying technology—blockchain—presents vast business opportunities in various sectors, including supply chain management, healthcare, real estate, and digital identity verification. Blockchain's ability to provide transparency, security, and efficiency in record-keeping makes it an ideal solution for industries that require the immutable storage of data. For example, blockchain can be used to track and verify the authenticity of products in the supply chain, particularly in industries such as pharmaceuticals, where counterfeit products are a major concern. In real estate, blockchain platforms could streamline the buying, selling, and leasing processes by eliminating the need for intermediaries and reducing transaction times. Cryptocurrency payments will also become more widely accepted by businesses globally, creating opportunities for startups that provide crypto payment processing solutions or develop decentralized finance (DeFi) platforms.

6. EdTech and Remote Learning Solutions

The COVID pandemic brought a seismic shift to the education industry, accelerating the adoption of remote learning solutions and edtech innovations. By 2025, the demand for online education platforms, virtual classrooms, and educational technology tools will only increase, as the digital transformation of the education sector continues. Remote learning is no longer seen as a temporary solution but rather a permanent aspect of education, providing a wealth of business opportunities for entrepreneurs and investors.

EdTech platforms that offer flexible, accessible, and interactive learning experiences will thrive in 2025. From K-12 education to adult learning and corporate training, businesses that can offer engaging digital content, personalized learning plans, and easy-to-use platforms will be in high demand. Additionally, businesses that develop tools to improve teacher-student engagement, such as gamified learning platforms or AI-driven tutoring services, will find themselves in a strong position to capitalize on this growing market.

Opportunities also exist in vocational training and certification programs, particularly in emerging industries like AI, data science, and renewable energy, where the demand for skilled professionals is rapidly growing. Entrepreneurs who can create specialized online courses or offer certification programs that cater to these high-demand industries will find abundant opportunities in 2025. Moreover, partnerships between educational institutions and tech companies to develop next-generation learning tools and technologies will open up even more avenues for growth.

7. Sustainable Food and Agriculture

Sustainability is a major driving force in global consumer behavior, and this extends to the food and agriculture sector. By 2025, the demand for sustainable food production methods, plant-based alternatives, and innovative farming techniques will create substantial business opportunities. As populations grow and the need to reduce the environmental impact of traditional farming becomes more urgent, entrepreneurs who focus on sustainable agriculture and food technology will find themselves at the forefront of this growing industry.

Vertical farming, hydroponics, and aquaponics are set to become more popular as cities look for ways to produce food locally and reduce reliance on traditional agricultural methods that require vast amounts of land and water. Businesses that develop innovative farming technologies, such as automation tools for vertical farms or AI systems to optimize crop yields, will see significant growth. Additionally, the plant-based food market, including meat and dairy alternatives, is expected to continue its rapid expansion, providing opportunities for startups to create new and improved alternatives that appeal to health-conscious and environmentally aware consumers.

In addition, businesses focused on reducing food waste, whether through innovative packaging solutions or apps that connect surplus food with consumers, will find themselves in a strong position to capitalize on growing environmental concerns. Entrepreneurs who can create sustainable supply chain solutions that minimize food waste or reduce the carbon footprint of food production and transportation will be well-positioned for success in 2025.

8. Cybersecurity

As businesses and individuals become more reliant on digital systems, the need for robust cybersecurity solutions will continue to grow. By 2025, cybersecurity will be a critical concern for organizations of all sizes, from multinational corporations to small businesses. The rise of sophisticated cyber threats, data breaches, and ransomware attacks means that businesses providing cybersecurity services, tools, and technologies will have numerous opportunities to thrive in this market. Companies that can offer comprehensive cybersecurity solutions, such as AI-driven threat detection systems, secure cloud storage platforms, or encryption services, will see a high demand for their services. Entrepreneurs who can develop tools to protect against emerging cyber threats, such as attacks on the Internet of Things (IoT) devices or autonomous vehicles, will also find substantial business opportunities. Furthermore, cybersecurity consulting firms that help businesses assess and mitigate risks will continue to play an essential role as regulatory requirements for data protection become more stringent globally.

2025 Global Business Opportunities Quiz

The global business landscape in 2025 will be shaped by technological innovations, shifting consumer preferences, and the increasing need for sustainability across industries. Entrepreneurs and investors who are able to identify and capitalize on these emerging trends will have the opportunity to create impactful and successful businesses. From AI and automation to renewable energy and digital health solutions, the future is full of possibilities for those prepared to innovate and adapt to a rapidly changing world.